With this growth in debt, LIVX currently has US$14m remaining in cash and short-term investments to keep the business going. LIVX has built up its total debt levels in the last twelve months, from US$8.6m to US$15m, which includes long-term debt. Does LIVX Produce Much Cash Relative To Its Debt? Nevertheless, potential investors would need to take a closer look, and I’d encourage you to dig deeper yourself into LIVX here.

The following basic checks can help you get a picture of the company's balance sheet strength.

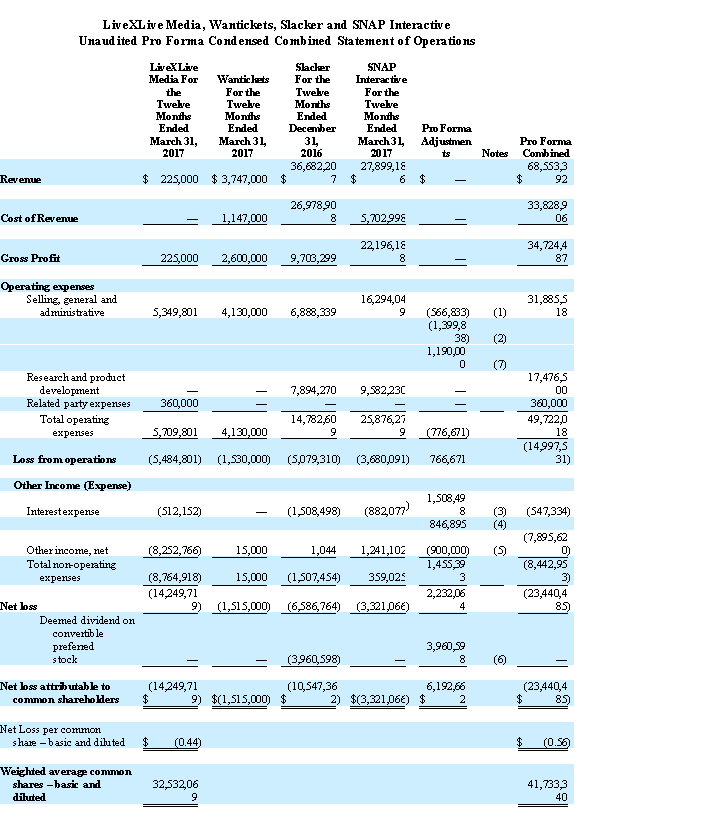

Why is it important? Since LIVX is loss-making right now, it’s essential to understand the current state of its operations and pathway to profitability. While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. ( NASDAQ:LIVX) is a small-cap stock with a market capitalization of US$249m. Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

0 kommentar(er)

0 kommentar(er)